Bullied into submission by vocal opponents of the 150-hour rule and watching CPA exam candidate numbers dwindle with each passing year, the AICPA and NASBA have floated a completely insane idea that couldn’t possibly have any merit whatsoever (do I really need to /s here?): A competency-based pathway that would serve as an alternative to the current 5th year of education requirement for CPA licensure.

From the press release they put out today about the proposed CPA Competency-Based Experience Pathway:

Designed to increase flexibility for candidates, respond to market conditions, and protect the public, the pathway allows candidates to meet the final stretch of licensure requirements by exhibiting competencies according to a model framework that has been developed by AICPA and NASBA. The framework was developed with significant input and advice from a diverse cross-section of the profession, including members of an AICPA and NASBA working group made up of practitioners, regulators, academics, and state society leaders.

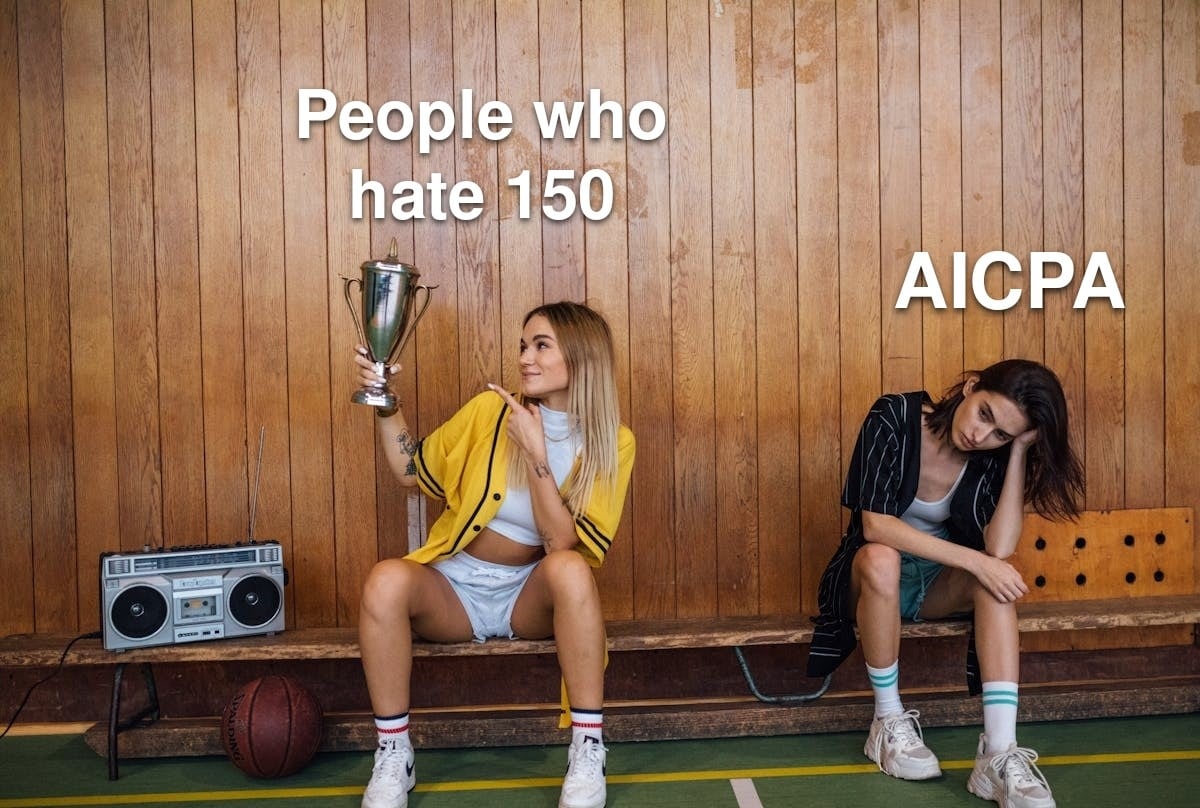

Recycling this gif from “Did the Anti-150 Hour Crowd Finally Beat the AICPA Into Submission? Looks That Way” because lol:

“The proposed pathway encompasses the perfect mix of flexibility for CPA candidates while maintaining rigor for public protection,” said NASBA President and CEO Daniel J. Dustin, CPA. “We look forward to the input and direction from the 55 U.S. Boards of Accountancy on this important and necessary framework to strengthen the CPA pipeline.”

Let’s remember this is the same group that fought hard to keep the 150-hour rule in place even when everyone else, even academia, was saying the profession should think about ditching or at least modifying it. The 150-hour rule has been successful in artificially inflated Underwater Basket Weaving 101 class lists at universities across the country for two decades, making better CPAs not so much. But sure, let’s talk about “maintaining rigor for public protection” now.

Said Journal of Accountancy in their write-up:

The proposed professional competencies are:

- Ethical behavior;

- Critical thinking and professional skepticism;

- Communication;

- Collaboration, teamwork, and leadership;

- Self-management and continuous learning;

- Business acumen; and

- Technology mindset.

The proposed technical competencies are:

- Audit and assurance;

- Tax; and

- Business and financial reporting.

The competencies, which would be verified in the workplace by licensed CPAs, are expected to take most candidates a year, but there is flexibility in the timing for completion.

Comments on the CPA Competency-Based Experience Pathway are open until December 6. If you have unhelpful troll comments to make or shitposting to do, please do so in our comment section and not the AICPA’s form. I’m serious.

Exposure draft in its entirety below:

Exposure draft: Proposed “CPA Competency-Based Experience Pathway” [AICPA]

The big firms who cheat on ethics CPE tests would be fantastic at signing off on a staff’s “competencies” that they thoroughly mastered while grunt-working through auditing cash.

What kind of profession willingly degrades its own standards for a false sense of inclusivity?

By lowering the bar, we turn the CPA designation from a symbol of rigorous excellence into a mere badge of convenience, stripping away the true value of our expertise.

Those who dismiss this as an old-fashioned notion fail to grasp the essence of professions and guilds.

Unlike doctors, who rarely exploit their peers due to mutual respect and shared intellectual rigor, the accounting field often succumbs to exploitation driven by diminishing standards.

This erosion of prestige isn’t just a betrayal of our own values; it’s a deliberate strategy for profit at the cost of genuine professionalism.

This generation of CPAs risks losing the sense of camaraderie built on skill and respect, reducing our role from esteemed professionals to credentialed managers. The distinction between a respected profession and a mere commodity is becoming alarmingly blurred.

“Unlike doctors, who rarely exploit their peers due to mutual respect and shared intellectual rigor”

You say you’re retired in Manilla, so I guess you can be forgiven for not knowing the current state of the medical field in the US.

Every time that I think the AICPA can’t get dumber, they prove me wrong.

(I promise to keep that out of my official comments on the exposure draft. Thank you for making me aware that they were requesting comments so that I can provide professional ones to them in due course)

They should stop the pretense just and raise the standard back up to where it used to be – 4 year degree, 2 years of experience.

I used to be a very involved AICPA Volunteer.

The CGMA money grab made me pay closer attention.

The CIMA merger drove me away from volunteering.

This obscenity may cause me to not renew my membership.

Look, the 150 hour idea was dumb from day one. I could get behind needing a master’s degree in accounting (doctors and attorneys need advanced field-specific degrees) but like the post said, it just became 20-30 hours of golf and basket weaving.

But this competency thing is somehow worse.

If we aren’t going to require 150 hours or an advanced degree… then just set the standard at a bachelor degree, the necessary business and accounting classes, and 2-3 years of practical experience. Degree plus experience works for many other professions.

“The competencies, which would be verified in the workplace by licensed CPAs.”

Well doesn’t that sound like CPE? Smells like another way for NASBA and the AICPA to make money.

On the bright side, they finally conceded and are presenting a non-150 hour rule alternative. However, it’s too little, too late.