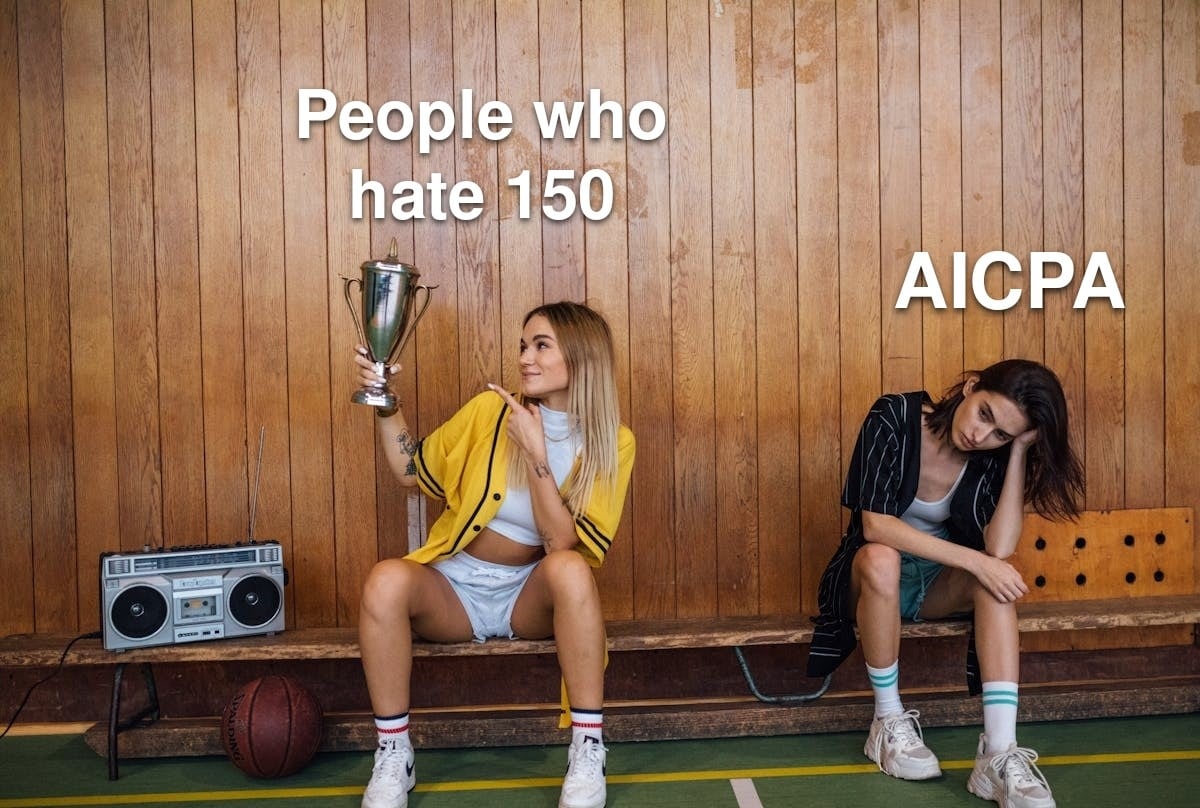

Stephen Foley at Financial Times wrote something today that may be of interest to high school freshmen bound for the CPA track one day, an article that suggests the AICPA is giving up the fight to save 150 hours.

The leaders of the US accounting profession have signaled they could cut the education requirements for becoming an accountant, amid growing alarm about a shortage of new recruits.

The American Institute of Certified Public Accountants on Tuesday dropped its opposition to calls to reduce the amount of university education needed to qualify as a CPA.

Before anyone gets too excited, we have to remember that under normal conditions, implementing changes across all 55 CPA jurisdictions could take years. There’s a long, tedious process that often ends in the state capitol with a bunch of non-CPA lawmakers ultimately deciding whether or not to bequeath an education break on the state’s future professionals. No doubt the states have many enthusiastic amateur lobbyists happy to enlighten the legislature on why this change is not just a good thing but a necessary one if Minnesota is representative of the rest of the nation. Proponents of reducing education requirements have been nothing if not vocal about their opposition to the AICPA’s official position.

And before we beat up the AICPA too hard for only just now conceding ground on 150, we have to remember that their most valid talking point throughout this battle — a battle they were pretty much guaranteed to lose as a chorus of voices rose up from all corners of the profession against it — has been mobility. “Because this system was put in place decades ago, many CPAs practicing today may not remember life before CPA mobility,” said the National Pipeline Advisory Group in their recent draft strategy report [PDF]. They put it in bold blue text, no less. The subtext here is that currently practicing professionals may take it for granted because they’ve never had to think about it.

Substantial equivalency basically means the states agree that they trust other states to adequately gatekeep the CPA rather than requiring individuals to be licensed in each state they practice.

The official definition of substantial equivalency as it appears in the NPAG report:

Substantial Equivalency: Substantial equivalency is the determination by a state that CPAs from another state meet the threshold to practice public accounting under CPA mobility. While there are some variations and exceptions, licensing requirements are remarkably consistent from state to state and that has powered the unique mobility system the profession enjoys today. The most consistent and critical elements are the 3 Es, education, exam, and experience, which underpin substantial equivalency and mobility.

And here’s what NPAG said about discussions they’ve had about the future of CPA education. We suppose they figured out what the AICPA couldn’t, that mobility has to take a back seat to a critical shortage. It was getting harder and harder to ignore the evidence that 150 is actively driving students — in particular minority ones — away from accounting.

While the AICPA Council resolution convening NPAG aimed at preserving mobility while also addressing the pipeline challenge, NPAG members agreed they needed to explore all options to ease the time and cost of education – even those that might impact substantial equivalency and mobility. As a result, the group committed to and has practiced an “everything’s on the table” approach to its learning and solutioning.

FT continues:

An AICPA advisory group that included representatives from large and small firms said on Tuesday that the profession needed to “address the cost and time of education” as a priority for fixing the shortage.

It called for “a competency-based licensure model not tied to university credit hours”, among other reforms. The AICPA, in turn, expressed “directional support” for the group’s recommendations.

“While expanding approaches to CPA licensure alone will not solve the accounting talent problem, we believe our licensure process does need to acknowledge changing market conditions,” the AICPA said.

The AICPA’s answer thus far has been the Experience, Earn, and Learn Program. For more on that see What Would the Accreditors Say About AICPA’s ELE Program?

The FT piece also says that AICPA CEO of Public Accounting Sue Coffey (not to be confused with outgoing AICPA CEO of Everything Barry Melancon whose retirement in December was announced today) said the AICPA “aimed to propose an alternative to the current requirements by this time next year, but getting state accountancy boards or state legislatures to embrace the changes could take significantly longer.”

“I really hope Minnesota and others talking about this see value in working with the rest of the country,” Coffey said. “This is our attempt to bring everybody together.”

Kind of funny the group most in opposition to what the rest of the country has been saying is saying that now.

As always, I remain skeptical of how this will actually shake out. I wouldn’t celebrate the death of 150 units just yet.

Thank goodness. It was the most tone deaf, pitching a hissy fit, digging my heels in because damn it we are the AICPA and very bad decision they made in trying to maintain the 150 rule. Let’s be honest 1. Diversity in the accounting profession didn’t just sneak up on this group 2. Student loan debt is a major issue and to make students take an additional year of college thereby adding more debt was ludicrous 3. Partnering with Tulane for a 30 hour program (note: I love Tulane it’s a great university) smacked of elitism 4. The world is changing and universities need to change their style of teaching so that accountants leaving have the skills that firm so they need from the new employees they hire at college. 5. I think the AICPA should continue their approach to try to bring in more minority groups into the accounting profession. I think that’s a very noble and very important one.

I was glad to see that Barry melanin has hailed his pirogue to take him back down the bayou. The association needs a fresh voice with fresh ideas that can work not only with the firms and establish members, but the Young members entering the profession as well as corporate members who have management accountants on their team and represent the whole of the accounting profession and not solely on CPAs.

The 150 hours was a bad idea 15 years ago when it was enacted and its a worse idea today. The fact that its taken this long for the AICPA to drop its opposition speaks volumes and all the while spending my dues $$ to demonize Minnesota and fight against the correction of a wrong-headed policy.

They shouldn’t just be dropping their opposition, they should have been leading the way.

The 150 credit rule is a great bar for kids these days. If they think that is hard, wait till they get into the Big 4 and have to work 80 hours in busy season.

So, you are saying they should have to pay their dues in order to land a slave labor type job when 120 hours is all they need in other fields that allow them a life outside of work.

All of us learn at a very early age that when you make a mess you need to clean it up. Minnesota didn’t create this problem, they just had the audacity to tell the powers that be at AICPA and the NASBA the hard truth.

Pretty much every CPA in the country over the age of 50 knows that 120 credit hours plus the exam plus 2 years experience works. And mobility wasn’t an issue and still isn’t since we all got grandfathered in.

The profession doesn’t need out of touch leadership to tell us how many years it will take to study a way to fix the problem they created. We need leadership to take action and do it quickly.