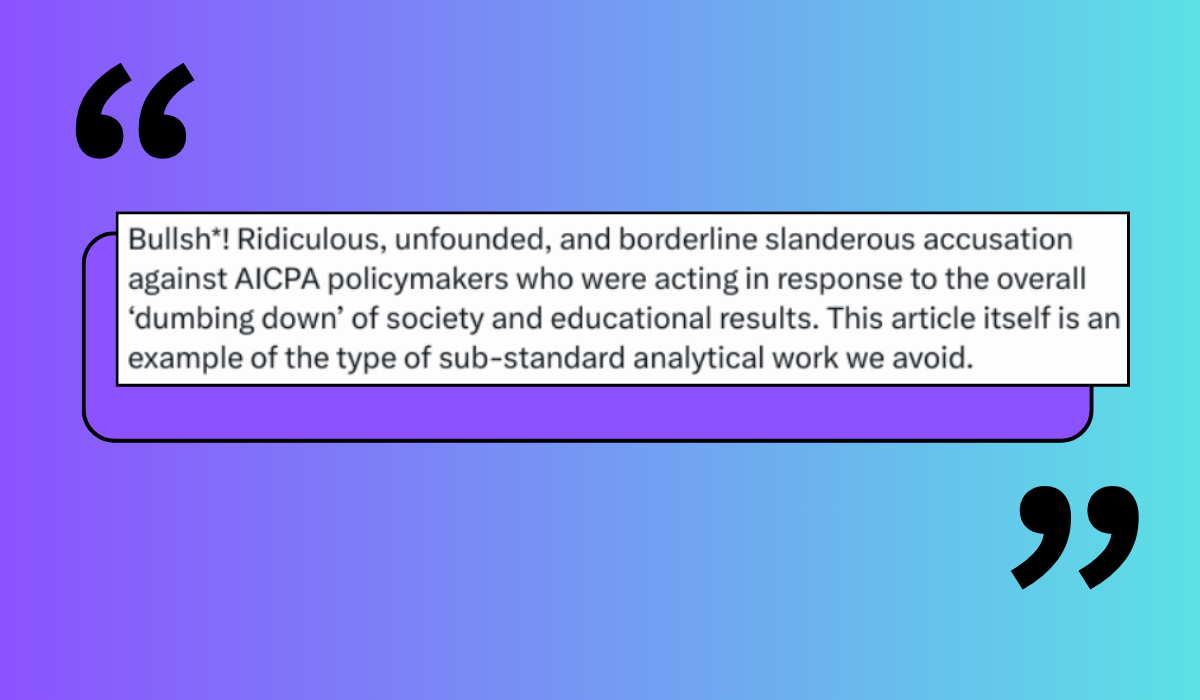

So this happened on Twitter:

The article is not ours (hence the compliment for good reporting and citations) but rather published on ProMarket: Young People Are Shunning the Accounting Profession. The 150-Hour Rule Is Responsible.

In the piece, industry OG Ray Ball wrote:

Why would accountants voluntarily increase the cost of producing their largest input (CPAs) when the additional cost could not be passed on to clients? Economists have long been skeptical of occupational licensing. Adam Smith’s long discussion of apprenticeships concludes, among other things, that lengthening the required duration of apprenticeship increases the earnings of incumbents, denies the rights of those who now cannot enter, and provides no assurance of increased work quality. Echoing this, Milton Friedman observes that occupational licensing typically is advocated by producers, not consumers, on the alleged grounds of public and not personal interest. It is important to note that the AICPA vote to require an extra year of college for entry to the profession was conducted among its incumbent members (i.e., currently licensed accountants), and not among CPA firms (their employers). The Rule does look more like incumbent accountants voting to restrict entry than to enforce quality. It has reduced entry to the profession to a level that does not satisfy demand. And it has fallen more heavily on minorities.

When we say OG, we don’t mean a guy who’s slaved away over hot ledgers for 50 years, this guy is an O G. His bio reads:

Ray Ball is the Sidney Davidson Distinguished Service Professor of Accounting Emeritus at Booth. He pioneered the application of financial economics to accounting. He (with his co-author Philip Brown) was first to demonstrate the link between firms’ accounting earnings information and their market values. He also was first to identify the existence of systematic anomalies in efficient market theory. He has received many awards, including five honorary degrees and inductions to the American and Australian Accounting Halls of Fame.

He was elected to the Accounting Hall of Fame in 2009 and to the Australian Accounting Hall of Fame in 2018.

So yeah, direct any accusations of slander his way please.

The AICPA is inevitably going to need reset the credit hours and experience requirement back where it was. The future of the profession is at stake. I think if they put it to a vote of their dues paying members, there would be overwhelming support for it.

Genuinely asking – wouldn’t every state legislature need to pass a law to go back to 120? If the AICPA supported it, it may be easier to get a law passed, but it’s still a huge undertaking beyond their control? A scenario where half the country is 120 and the other half is still 150 would be a non substantive victory. The large firms (which is who hires all the undergrads) would still require 150 because of the cross jurisdictional nature of their clients and services.

Tony, that would be libel, not slander.

From what I’ve read so far regarding this, surveys from firms in various states claim that they see little difference in the abilities of those who had the extra 30 hours and those that do not. The old cost/benefit analysis, should be employed with the cost to the profession(less and less long term employees in firms), compared to the benefit(apparently very little). If the majority of firms surveyed said the difference in skill level relating to the extra 30 hours was significant, then I’d be backtracking. But anybody who thinks this is not costing the firms in quality employees, especially those who will stay and move up through the ranks, is blinded by professional politics.

Honestly accounting in industry, or a whole other field of employment, is often more accessible with the same or better pay. I just don’t get the stubbornness in trying to paint a shinier picture than what truly exists as the answer, when it should be dang obvious the 150 hours is not the hill to die on.