TLDR: Scroll to the bottom, it’s the second-last paragraph.

Traipsing haphazardly across the internet as one does, I came across this ancient scroll dated 1988 and entitled “Education requirements for entry into the accounting profession: a statement of the AICPA

policies.” When I say ancient, I mean ancient. Serif fonts hadn’t even been invented yet.

policies,” 1988 [PDF]

The introduction looks familiar. As the profession evolves, the profession’s gatekeepers are tasked with periodic review of the requirements to become a CPA. This is how BEC got killed off and we ended up with CPA Evolution, because the necessary entry-level knowledge of a CPA today is much different from that of a CPA 15 years ago. Reasonable.

It is the policy of the American Institute of Certified Public Accountants (AICPA) that “ the knowledge to be acquired and abilities to be developed through formal education for professional accounting are proper and continuing concerns of the AICPA” and “the AICPA should review periodically the standards of admission requirements for CPAs.” To fulfill the AlCPA’s responsibility under this policy, the Education Executive Committee decided in 1986 to review the 1978 Education Requirements for Entry Into the Accounting Profession (the Albers report) to determine how the sample program contained therein should be modified to reflect changes that had taken place and trends that were expected to continue. After identifying significant changes occurring in public accounting, industry, and not-for-profit organizations, the Education Executive Committee engaged in extensive discussions of the impact these changes should have on education for CPAs.

And this is the AICPA’s official policy on education requirements for entry into the accounting profession in 1988:

- The CPA certificate is evidence of basic competence of professional quality in the discipline of accounting. This basic competence is demonstrated by acquiring the body of knowledge common to the profession and passing the CPA examination.

- Horizons for a Profession is authoritative for the purpose of delineating the common body of knowledge to be possessed by those about to begin their professional careers as CPAs.

- At least 150 semester hours of college study are needed to obtain the common body of knowledge for CPAs and should be the education requirement. For those who meet this standard, no qualifying experience should be required to sit for the CPA examination.

- The scope and content of the educational program should approximate what is described in Academic Preparation for Professional Accounting Careers and should lead to the awarding of a graduate degree.

- At the earliest practical date, the states should adopt the 150-semester-hour education requirement. The date by which implementation of this policy may be practical may be dependent upon the following factors: (1) the current education requirement in each jurisdiction, (2) the availability of graduate accounting education in each jurisdiction, and (3) appropriate lead time to permit individuals to meet proposed education requirements.

- Candidates should be encouraged to take the CPA examination as soon as they have fulfilled the education requirements, and as close to their college graduation dates as possible. For those graduating in June, this may involve taking the May examination on a provisional basis. [Ed. note: At the time this was published the CPA exam was given only twice a year, in May and November]

- Student internships are desirable and are encouraged as part of the education program.

- The AICPA should encourage the development of quality programs of professional accounting (or schools of professional accounting) and participate in their accreditation.

- Educational programs must be flexible and adaptive, and this is best achieved by entrusting their specific content to the academic community. However, the knowledge to be acquired and abilities to be developed through formal education for professional accounting are proper and continuing concerns of the AICPA.

- The AICPA should review periodically the standards of admission requirements for CPAs.

Published prior to the moon landing, Horizons for a Profession – The Common Body of Knowledge for Certified Public Accountants [PDF] is so old it may have initially been written on papyrus paper. That’s what they’re referring to when they say “Horizons” above.

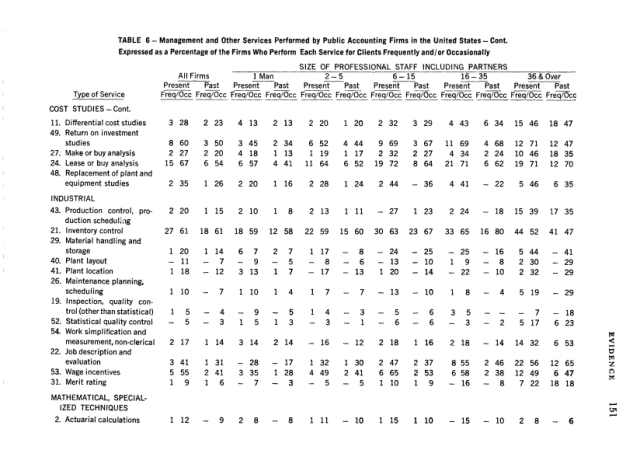

The scanned version is 346 pages so we won’t dig too deep into it but there are some interesting bits in there if you are a nerd who’s into accounting history (me).

Like how many firms performed what services:

Point being, Horizons gets many mentions in the 1988 report as does the “Education requirements for entry into the accounting profession” report published ten years before the one we’re talking about [PDF]. Dubbed the Albers report, the 1978 version came out five years before Florida became the first state to adopt the 150-hour rule.

But let’s get back to 1988 and this part in particular. Many people have questioned why the 150 hour rule lacks any requirement for specific education, especially so now that there’s a contentious debate raging about its continued existence. I mean, if it’s so critical to the public interest then why can it be met with whatever? The 150 hour rule may not have improved the quality of professionals since its widespread adoption but it sure gave us a lot of expert underwater basket weavers.

This is what the report says:

The profession requires that its entrants be men and women whose education has provided them with the foundations for lifelong learning, development, and growth. No attempt is made here to completely delineate the content of a CPA’s general education because it does not always relate directly to the demands of professional practice. Students should come to understand humankind, its history, the philosophies by which it lives, the languages in which it communicates, and the arts and sciences that enrich its existence. Emphasis should be on developing analytical abilities and problem-solving skills, as well as perception, judgment, and integrity. [emphasis ours]

Huh. Who knew.

What’s frustrating is that each state determines what “Whatever” means. In Florida, they have no criteria on their 150-hour requirement, after you get your required business/accounting done you can register for those calligraphy courses. However in Texas, after I met my business and accounting requirements I was informed that I needed to specifically take 3000 level course work or higher for it to count towards the 150-hour requirement. I was about to take some intro SQL classes to make up the gap and learn a new skill, instead, I gave the bare minimum effort to pass a handful of additional accounting courses.

I’ve been a practicing CPA since 1975 and am a former Big 8 audit partner. All of this discussion is based on a lie. When the 150 rule was adopted, the real discussion was about too many graduates in accounting and the need to raise obstacles to keep the value of being a CPA from being diminished. Classic restraint of trade. Everything else was justification. The AICPA/FASB/GASB is a corrupt organization unable to foresee or accept the consequences of its actions.

Someone that was around for all of this once told me that they wanted to make the 150 hour requirement accounting specific. In some states, the universities and their lobbyists told politicians not to support any bill that prescribed curriculum. The education lobbyists have more pull than the accounting lobyists. When it became clear they could not get the state confressional votes to pass a prescribed 150 hour requirement, they settled for the generic rewuirement. The universities were happy to support it because it was more revenue an no loss of control/power). If all that is true, the book appears to just be the PR spin for the rule they ended up with.