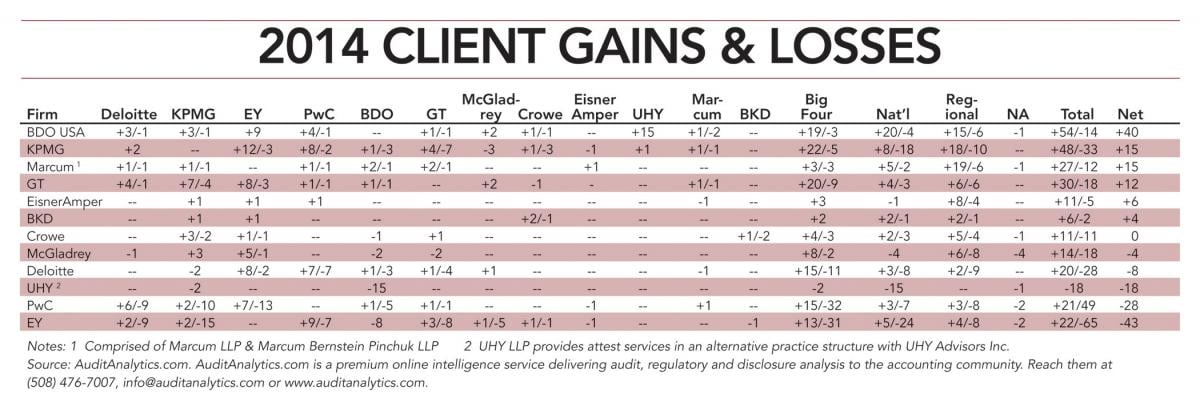

As mentioned this morning, BDO did pretty well last year, winning net 40 new SEC audit clients in 2014. The firm actually won a total of 54 new engagements, slightly more than 1 new client a week. That's pretty good!

Now for bad. Really, really, really bad. Here's the table from Accounting Today, that compiled data provided by the stellar team at Audit Analytics:

Sorry, go here if you can't stand squinting.

Sorry, go here if you can't stand squinting.

EY lost 65 SEC audits last year, net loss of 43. That seems like a lot! I mean, when we reported back in Q2 of 2013 that the firm was losing more than one client a week, that seemed like a lot, too!

This is quite a bit worse than last year when the firm dropped a net 28 clients last year.

What's the dealio? Well, you may remember that the firm launched their 2020 initiative a couple years back that included a revenue target of $50 billion. While the firm had a nice 2014, with revenues above $27 billion, there's quite a bit of work to be done if they're to reach the $50bil mark.

Advisory (aka consulting) and transaction services (aka consulting) were two biggest growth areas for the firm and, unless something dramatic happens, they'll be the two biggest growth areas in 2015 as well. As these service areas grow, some conflicts are bound to come up with some of the firm's audit clients. And you'd have to be a damn fool to think that EY would rather keep an audit engagement over new consulting work. Not to say that's the primary driver of the 2014 audit client losses, but in each case, EY already has a touch point with those companies. Once that the burden of independence is gone, the firm can start proposing all kinds of fancy services without any hindrance of conflict.

Just like PwC and Deloitte (who also lost a fair number of audit clients), EY is officially going all honey badger on assurance services. And why not? They've got a big goal they want to reach. They'll keep the shiniest audit clients and ship off the rest to, from the looks of it, BDO, GT and KPMG.