Ed. note: enjoy some wisdom from a profession OG in this guest post from Blake Oliver. TLDR: Patience, intellectual curiosity, soft skills, and time management will take you far. Most importantly, advocate for yourself.

Different generations in the workforce often struggle to understand each other. But experts say one thing that young professionals can do, including young accountants, is to be more patient.

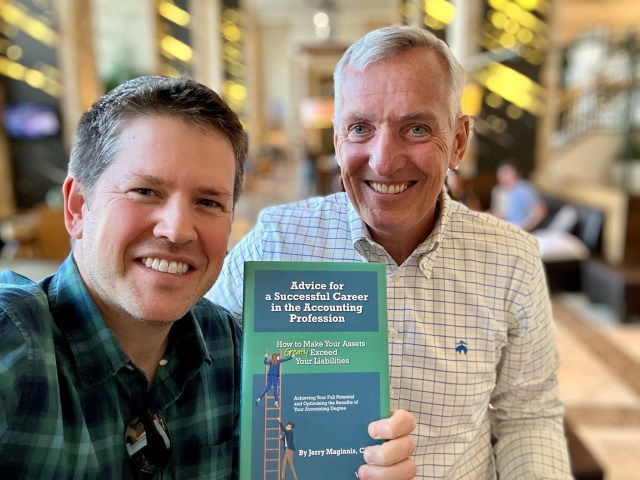

Jerry Maginnis, former office managing partner of KPMG in Philadelphia and author of the new book Advice for a Successful Career in the Accounting Profession: How to Make Your Assets Greatly Exceed Your Liabilities, told me on my podcast that younger professionals have short attention spans and they’re very interested in what’s next. Their mindset is: “I’ve been doing this job for six months; when will I get promoted?” or “When will I have my next opportunity?” That kind of ambition is not necessarily a negative, but Maginnis said it can get in the way of a successful career if they change jobs or switch departments every time they hit a few bumps in the road.

“Let’s say they’re in public accounting, and they get assigned to an engagement with a manager or client they don’t particularly like,” asked Maginnis. “Or suppose they have to put in very long hours for a few weeks. Too often, young people will say: ‘That’s it. This isn’t the right profession for me. I’m leaving.’”

Instead, Maginnis said you have to give things time to play out because your next engagement might be with great people and a terrific client that ends up defining your career. But by bailing out too soon, you miss it. Maginnis recalls early in his career when Newt Becker, founder of the Becker CPA exam prep courses, told him that every year spent in public accounting is the equivalent of two years in private industry. But too often, young CPAs flee public accounting for what they believe are the greener pastures of industry and miss out on that learning and development.

It’s no secret the workload is notoriously tough for young accountants starting in the Big Four. It’s often described as “trial by fire” or “getting thrown into the deep end of the pool.” This could intimidate and discourage anyone, including people just starting their careers. But you have to show some grit and not be afraid to ask for help.

As Maginnis details in his new book, firms of all sizes have become much more sensitive to the importance of work-life balance, mental health, and the overall well-being of their employees. “As a profession, we have a way to go, but there are many firm-wide programs and initiatives to support young professionals through this,” noted Maginnis. By the same token, Maginnis said young professionals are sometimes “their own worst enemy” because even at age 22 or 23, they need to take ownership of their schedules (and their lives) and set priorities. He said firms don’t expect anyone to work 75 to 80 hours a week, and you shouldn’t be afraid to ask for flexibility – even during busy season – if you have important family or social commitments during the early evening on weekdays. He said you can usually trade off with co-workers to go home earlier on those nights and then work later on other nights.

Maginnis said most firms give you 30 days of PTO when you walk in the door. That’s the equivalent of six weeks off right off the bat. And for much of the year, the workload is closer to 40-hour weeks, with occasional 50-hour weeks.

Intellectual curiosity, advocate for yourself

“At KPMG, almost everyone came in with a baseline level of skills that enabled them to be successful in their job,” observed Maginnis. “The ones who rose to the top were the ones who showed great intellectual curiosity and who were avid learners.” In other words, they weren’t satisfied with understanding debits, credits, and audits. They wanted to know about the client’s business model and how they made money.

They wanted to know about their international expansion strategy and technology use. “The hallmark of a great auditor is not just understanding debits and credits, but understanding how the client makes money and the economics and the cash flows,” added Maginnis. “A lot of the auditing failures we’ve seen in the past could have been avoided if people got beyond the debits and credits and thought about the substance of the economic transactions they were auditing and whether or not they made sense,” noted Maginnis.

From where I sit, accounting gives you a great window into the inner workings of a company. That’s why it’s such valuable training for many business careers.

Importance of soft skills

While there is so much emphasis on staying current with technical skills, I’ve found that so much of success in the accounting profession revolves around your ability to work effectively with others, whether it be your client, colleagues, or peers. You could be the smartest person in the world and have all the answers. But if you’re challenging to interact with, you’re probably not going to do well. One of the most common complaints Maginnis hears from fellow managers is that their younger colleagues don’t possess soft skills. He’s hoping to see soft skills stressed more in the accounting curriculum but feels many advisory boards think some of the ever-changing “core requirements” would have to be eliminated to make room for soft skills. That can be a tough fight to win.

Maginnis recalls a situation early in his career when he was assigned to a large engagement with a principal client official who was rude and hostile toward the entire audit team. Instead of bad-mouthing the official or begging for a transfer, Maginnis invited the hostile client official out for coffee and tried to understand where he was coming from.

Maginnis quickly learned the official needed help understanding the role of independent auditors or why they were asking him to do certain things or provide so much documentation. However, after Maginnis patiently explained the role of auditors, the client asked Maginnis for regular weekly coffees and pointed out several areas in which KPMG could be more efficient. Long story short, Maginnis made partner a few years later, and the once hostile client was among the first to write him a congratulatory letter.

It’s a great success story, but Maginnis quickly points out that bringing in the business and building client relationships is not the only criteria for making partner. He said soft skills that include building relationships with team members and helping younger professionals achieve their potential are just as critical as business development and strong technical skills.

And, of course, having a high degree of intellectual curiosity about understanding the client’s business better or what’s keeping the C-suite up at night. “What are their biggest challenges? What are their biggest opportunities?” asked Maginnis. “It’s about being not only a student of the client (what their needs are) but being a student of your own firm — knowing all of the firm’s capabilities and how they can help the client make better decisions,” noted Maginnis.

Specialties to consider

Every business needs accountants, from local mom-and-pops to multinational corporations. “Young people today have the opportunity to marry a personal passion with the type of organization that needs accounting services,” said Maginnis. “It could be sports and entertainment, tech companies, life science companies.” There are also hot areas of specialization, such as forensic accounting, since AI has accelerated the pace and scope of fraud. There’s also the cannabis industry, digital currencies, and artificial intelligence. These emerging industries have some unique accounting and reporting issues and tax issues.

As a profession, we must better explain why accounting is a great, exciting profession and why it can provide young people with many opportunities. Unfortunately, Maginnis said the awareness level is not where it should be, and the stereotype of long hours, tedious work, unappreciative clients, and nerdy coworkers persists. He said the misconceptions became readily apparent after he retired from KPMG and started teaching at Rowan University near his home in New Jersey. He found the students highly motivated and curious about stable careers like accounting. But, they had concerns about the long hours, the 150-hour rule, the fear of boredom, and the lack of work-life balance.

Conclusion

“It dawned on me that there might be a broader need for explaining what accounting careers are like, the doors they can unlock, and the importance of forming good habits that will serve you well for a lifetime,” said Maginnis. What kinds of career advice are you giving young professionals? I’d love to hear more.

Blake Oliver, CPA, is the founder and CEO of Earmark and co-host of The Accounting Podcast, the No.1 podcast for accountants and bookkeepers.

Oh look, more “it’s your fault you’re dissatisfied with the accounting industry” lit from the people who rose to the top then scorched the earth behind them. Touch grass, boomer.

I’m loving the accountant Shortage. My pay goes up and up!

Accounting was a good profession decades ago when I began my career in onebof the Big 8, but today, you can make a lot more money working less hours in many other fields. Many young people are beginning to realize this, and choose fileds that pay much more right out of school and offer much better work/life balance. Good for them. If there’s any advice I would give college students today it’s: don’t waste your time with an accounting career because you’ll probably never be paid fairly for all the time you put in, and absolutely NEVER, under any circumstances, work for the Big 4. You don’t learn more in public accounting than in private industry. I worked for a Fortune 500 company and in recent years have found Big 4 alumni to be in arrogant and many times, incompetent. The idea that you need Big 4 experience is simply one of many lies that these firms use because they need to find ways to convince people to work ungodly hours for low pay. They prey on students fresh out of school because they are young, naive, and have no real frame of reference for what’s really out there in the corporate world. These firms are all run by the greediest of bean counters who only care about the bottom line, using people, and spitting them out.

Many solid points of advice here. Accounting is a great place to jump start a career. I am a millennial who has been in public accounting at large firms since graduating from a state university in 2010. Among my social circles I make the most money, have great flexibility, and enjoy working with interesting clients. Those that decide to exit public accounting after ~5+ years are well positioned for great industry jobs on track for executive level positions. No exorbitantly expensive graduate school or Ivy league network required. Sure, fields like tech have emerged with great starting salaries, but pay for new associates in public accounting has increased by nearly 50% since a few years ago. Not to mention this is a proven CAREER that has sustained decades of ups and downs. After the boom 2-3 years ago tech opportunities are not what they just recently were.