I’d like the record to reflect that this is not my idea.

I wasn’t able to find any information on the average cost of those extra 30 units, probably because it varies so much so instead let me drop two relevant links. You all are welcome to tell us how much you paid for your 30 units in the comments (or by email).

Rethinking the 150-Hour Requirement for CPA Licensure [CPA Journal] This one does a pretty good job of explaining the current debate over 150 units as well as the arguments for and against.

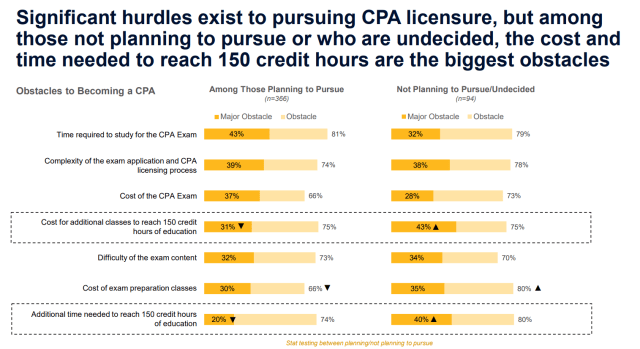

Increasing Diversity in the Accounting Profession Pipeline: Challenges and Opportunities [Center for Audit Quality] This CAQ research, now exactly a year old, dives deep into why students aren’t pursuing accounting or, if they did, why they aren’t interested in getting licensed. According to their research, 81% of undergraduate accounting majors plan to get their CPA. This research talks extensively about why the remainder don’t go that route and the cost of those extra units comes up quite a bit. As you can see from the chart below, cost is a hurdle to both the to CPA and to not CPA groups.

What doesn’t come up at all in that research is how people who scrimped and saved to make those 30 units happen are going to feel if the requirement is suddenly lifted in their state. Hell, even people who could afford it might feel some type of way.

Discuss. And let’s keep in mind this is tagged as a crazy idea, not a plausible and immediately actionable one.

How are you going to account for the people who took the non-traditional accounting path or switched careers and took a master’s program in accounting to be CPA eligible?

There is also probably a huge cohort of people who didn’t make the Big4/Big10 cut when those firms only recruited perfect GPA candidates from 2008 through at least 2016. I am in that cohort because I took a master’s program to “restart” my GPA because I was an engineering student before I switched to accounting in undergrad. In most engineering programs, having above a 3.0 was amazing considering how hard the material was and the dedication to your studies required to achieve that. Because of my engineering classes, my overall GPA in undergrad was a “measly” 3.2 and will never forget the “disguised” look on the recruiter’s face when I said that number. That should’ve been my sign to not be in this professional but I stubbornly went into my school’s master’s program for accounting and have a perfect 4.0 and every Big4 bent over backwards to recruit me. What a joke.

Times have sure changed, but one thing is for sure…you should not need 150 credits for the CPA.