Announced earlier today, Citrin Cooperman (IPA Top 100 #19 with $674,000,000 in revenue) is acquiring Clearview Group, a Baltimore metro-based management consulting and CPA firm. According to this, Clearview Group’s annual revenue is $8.5 million, this says $18.6 million and another listing on that same site says $30.4 million. So who knows.

Put on your tallest wading boots and let’s see the press release:

“We could not be happier to add a firm like Clearview Group to the Citrin Cooperman family. Clearview Group’s ability to expand our service offering and offer up-market solutions to our client base will allow us to continue to help our clients Focus on What Counts,” said Citrin Cooperman Advisors LLC CEO Alan Badey. “Clearview Group’s focus on a strong culture and technical excellence will fit perfectly with Citrin Cooperman.”

“We are thrilled to be joining Citrin Cooperman,” said Brian Davis, CEO of Clearview Group. “With Citrin Cooperman’s expansive geographical presence and impressive suite of world-class professional services and industry insights, this transaction enables us to expand the reach of our industry-leading risk and enterprise solutions to continue to provide clear solutions to the complex problems large corporations are facing in today’s ever-evolving market conditions.”

New Mountain Capital — the same PE firm that is pouring cash into Grant Thornton — has owned a majority stake in Citrin Cooperman since 2022.

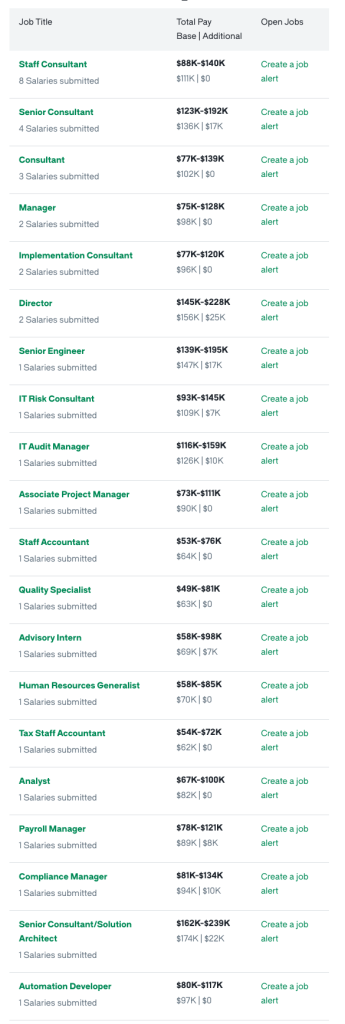

Let’s check out Glassdoor to see salaries at Clearview Group shall we?

Because modern day PE-backed deals are extra complicated, Citrin Cooperman Advisors LLC will acquire the non-attest assets of Clearview Group, Inc. while Citrin Cooperman & Company, LLP will acquire the attest assets of BD & Co., Inc., Clearview’s licensed CPA firm.

The press release says the transaction is expected to close November 2024 so…any day now.

Related: