This afternoon NASBA held a webinar on how to choose a CPA exam discipline and in case you couldn’t or refused to attend, I’ll have more on that later. For now, I wanted to share a tip from presenter Joe Maslott, PwC alum and Associate Director at the AICPA. TLDR: Don’t choose Tax Compliance and Planning (TCP) as your discipline just because of its high pass rate. Allow me to explain…

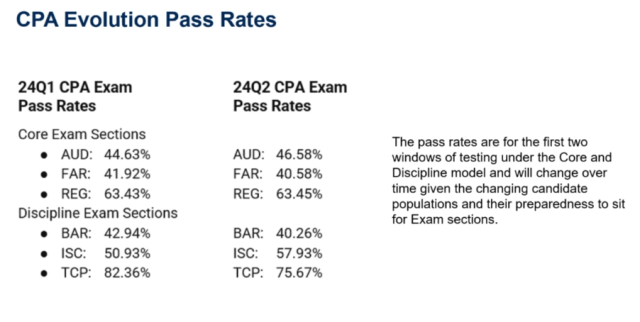

These are CPA Evolution pass rates for the first and second quarters of 2024. If you have working eyes, you’ll see Tax Compliance and Planning (TCP) has an obscenely high pass rate; 82.36% for Q1 and 75.67% for Q2.

I’m actually glad they covered this in the webinar because I’d wondered myself if TCP was just crazy easy or what. 82.36% is ridiculous.

The benevolent overlords of the CPA exam like to say that pass rates are not indicative of easier or harder exams but rather a reflection of the preparedness of candidates for any particular testing window. Meaning pass rates are higher when candidates are better prepared. To demonstrate this, I lifted this graphic of CPA exam section pass rates from Gleim that covers 2010-2023. Pay special attention to the red line representing BEC (RIP):

Did BEC suddenly get hard in 2023 when it went from a 60% pass rate in 2022 to about 47%? No. I mean, probably not. What did happen was a ton of people rushed to take it before the year ended because any active candidate who hadn’t passed BEC by the launch of CPA Evolution in January 2024 was going to have to choose one of the new disciplines and ain’t nobody got time for that. We can safely assume that many of these people weren’t well prepared thus the section’s pass rate tanked.

Looking at pass rates for 2023, we see a very predictable drop off at the end of the year across all sections except AUD. Again, expected. It’s the end of the year, people are distracted by the holidays, and with CPA Evolution coming around the corner you had a higher number of candidates rushing to sit.

| 2023 CPA Exam Pass Rates | |||||

|---|---|---|---|---|---|

| Section | First Quarter | Second Quarter | Third Quarter | Fourth Quarter | Cumulative |

| AUD | 47.01% | 48.24% | 45.65% | 46.41% | 46.75% |

| BEC | 56.98% | 59.16% | 54.90% | 38.17% | 47.44% |

| FAR | 41.82% | 42.78% | 44.08% | 39.36% | 42.12% |

| REG | 58.63% | 59.71% | 59.13% | 54.68% | 57.82% |

Do they make FAR even harder at the end of the year? Unlikely. But you do get a lot of people who have been dragging ass all year and want to squeeze in a section once it dawns on them that the year is almost over. Those people tend not to be overly prepared.

Back to the topic of TCP. In the NASBA webinar, Joe specifically said that TCP’s pass rate is higher — for now — because “a smaller number of well-prepared candidates did really well” on it in Q1. The AICPA even mentions this on their website:

In review and analysis of candidate performance across Discipline Exam sections in the 24Q1 testing window, the AICPA and the Board of Examiners noted TCP candidates were generally better prepared to take TCP than the BAR candidates were to take BAR and ISC candidates were to take ISC.

If you don’t know, BAR is FAR’s slightly less intimidating cousin. And contains cost accounting which so many people struggle with. So of course candidates didn’t kill it on BAR.

In the webinar, Joe added that he thinks TCP pass rates will go down over time as things normalize. Meaning the hardcore super studiers got it out of the way already, now it’s up to the average CPA exam candidates to take a stab at it.

All this to say, don’t take TCP just because it has the highest pass rate of the disciplines by far. Take it because you fucking love tax.

Related: