TLDR Assurance is out, Advisory is in.

CPA Journal has published an intriguing deep dive into Big 4 revenue, specifically how the firms started making more money in advisory than audit or tax in the last 10+ years. You should go read it if this is at all interesting to you but we’re just going to focus on two charts because the Going Concern audience, and its editorial team, have the attention span of squirrels that got into a case of Red Bull.

Covered in the article are several events over this 23-year period that put upward or downward pressure on Big 4 revenue, things like the collapse of Arthur Andersen dumping all those clients on other firms, Sarbanes Oxley, the 2008 financial crisis, and PCAOB paper-pushing.

Writes The CPJ:

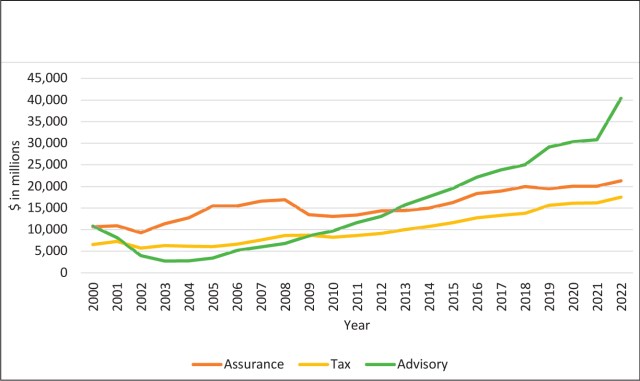

Over this period, audit revenue declined while advisory service revenue increased. Overall, the revenues of the Big Four have increased from $28 billion (2000) to $79 billion (2022); this represents a 183% increase over 23 years. The increase in overall revenue was interrupted by a decrease in total revenues from 2004 to 2006, during which time the firms (except for Deloitte) sold off their advisory service practices. The 2008 financial crisis contributed to the leveling off of revenues from 2009 to 2010. Contributions to revenue from advisory services were the lowest (14%) in 2005, while assurance and tax services were 62% and 24%, respectively. This sharply contrasts with 2022, when advisory service revenues were 51%, and assurance and tax service revenues were 27% and 22%, respectively.

The Big Four and the Rising Tide of Advisory Services in CPA Journal

And now, Exhibit 2.

Exhibit 2 shows that Big Four advisory service revenues grew from $11 billion (2000) to $40 billion (2022); this represents a 274% increase over 23 years. Revenue from advisory services was temporarily constrained by the enactment of SOX, which prohibited auditors from providing advisory service to assurance clients. In response, the Big Four sold off their advisory service practices one by one, except for Deloitte, which did not do so due to market conditions. Deloitte’s failure to divest may have provided an example of how advisory services may be sold to non-audit clients without violating SOX. Therefore, as the non-compete agreements with their former advisory arms expired, the other three firms began to replicate the success of the Deloitte business model. Advisory service revenue doubled from 2010 to 2015 and has continued to increase rapidly since then, leading to a concern about the impact of advisory services on public accounting firms (Alyssa Schukar, “Big Four Accounting Firms Come Under Regulator’s Scrutiny,” Wall Street Journal, March 15, 2022). Since 2014, total advisory revenues have exceeded total assurance revenues for the Big Four by 50% or more and growing. Deloitte is the clear leader in advisory revenue, followed by PwC, EY, and KPMG.

Here’s a link to that WSJ article should you care to peruse it.

During the period analyzed, cumulative assurance revenues at Big 4 firms doubled — from $11 billion in 2000 to more than $21 billion in 2022 — and tax went from $7 billion in 2000 to $18 billion in 2022, an increase of 168%.

They go on to analyze the individual firms’ revenue by service line, go check it out if you want.